Data verified & shared by airbtics.com

Koh Samui

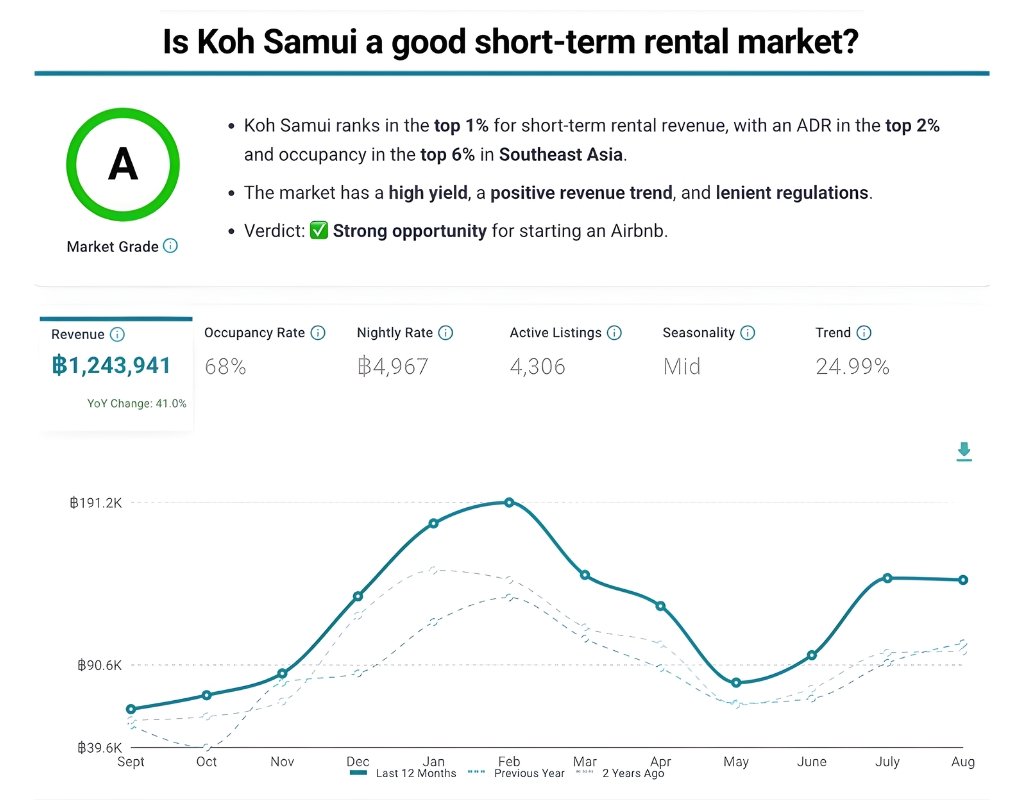

Occupancy: ~67%

ADR (Average Daily Rate): high

Seasonality: peak Dec–Feb

Active Listings : 5800

Best risk–return trade-off

Bangkok

Occupancy: ~66%

ADR: high

Seasonality: more pronounced

Active Listings : 15232

More competitive

Pattaya

Occupancy: ~55–60%

ADR: medium

Seasonality: moderate

Active Listings : 9008

Less premium

1st

2nd

6th

+25.89%

Market overview 2024 → 2025

Koh Samui remains one of Thailand’s most profitable destinations for short-term rentals. Strong demand, high revenues, flexible regulation

Supply & Demand

2-bedroom villa

฿ 1,831,024 / year

3-bedroom villa

฿ 1,831,024 / year

4-bedroom villa

฿ 2,879,725 / year

Sea view

Panoramic view

Private pool

Beachfront

24/7 concierge

Security

Privacy

Gym

Office

Daily housekeeping

SPA

Private cinema

Private chef

Private driver

Fees & Strategies

•

Cleaning fees

Significant cost but recharged to tenants

•

Water & electricity

Generally borne by tenants

•

Dynamic pricing

Maximizes revenue per available unit according to season

•

Cost optimization

Controlled OPEX = faster ROI

• Dynamic pricing (events, weather, flights)

• Premium asset design (photography, home staging, UX)

• Multi-channel distribution (Airbnb, Booking, direct)

• 24/7 operations (check-in, cleaning, maintenance)

• Monthly reporting & ROI optimization

Infinity seaview villa

฿ 5,500,000

Conclusion & Outlook

•

•

•

•

Rated 5 / 5

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nullam porttitor tortor turpis, vel semper massa hendrerit eu.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nullam porttitor tortor turpis, vel semper massa hendrerit eu.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nullam porttitor tortor turpis, vel semper massa hendrerit eu.